CREDIT RESTORATION GAME-CHANGER

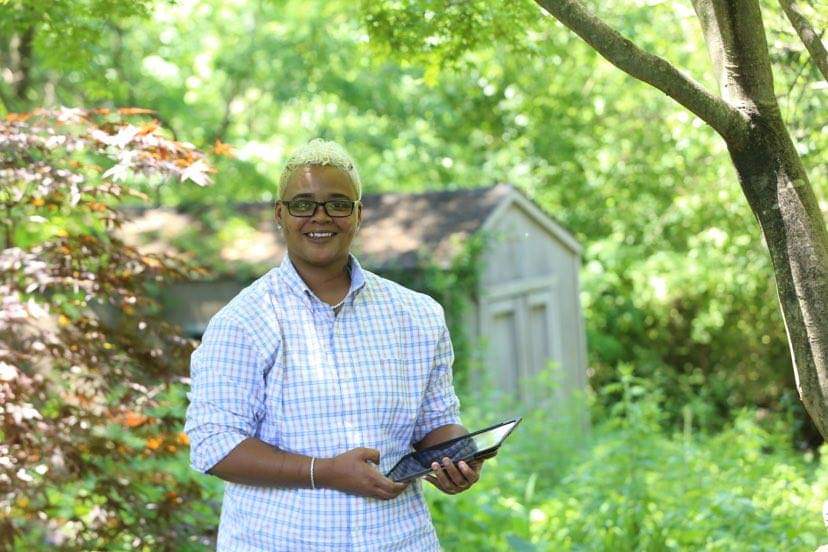

Michelle Davis is only keeping it real.

Or, in modern terms, she’s only keeping it 100.

That’s is because when it comes to the importance of credit repair — particularly why is it imperative for consumers to make essential changes regarding their credit status — Davis doesn’t shy away from the notion that she’s destined to help as many people as she can.

“If I had to choose a number of clients I’d like to help for the remainder of 2020 and 2021, I’d have to say limitless,” Davis, the owner and CEO of Michelle Davis Legacy LLC, told Making Headline News this week. “It is my goal is to help everyone who’s willing to help themselves.”

MORE ON DAVIS’ VENTURE: https://www.ucesprotectionplan.com/Default.aspx?rid=PDavis22

There are, by all accounts, a slew of reasons to support Davis’ argument.

There are, by all accounts, a slew of reasons to support Davis’ argument.

According to a November 2019 report by The Balance, it cites that low credit scores typically mean higher interest rates, and that means higher finance charges on your credit card balances, as mentioned at https://www.thebalance.com/reasons-to-repair-bad-credit-960379. Moreover, according to The Balance report, repairing your credit would allow you to get a more competitive interest rate and cut back on the money you pay in interest.

Also, in revealing “15 Reasons You Need to Fix Your Credit,” The Balance mentioned, among other things, that if you have bad credit, you’ll have a hard time getting a credit card, which means you’ll end up paying cash for everything. Not only that, it may not be a nuisance until you need to do something like renting a car, where you have to pay an extra deposit if you don’t use a credit card.”

All of which is why solid business professionals like Davis can very well prove to be a massive game changer in what is steadily shaping up to become an ever-so-competitive credit restoration industry, in large part because she’s seeking to attract a credible team of clients and agents to join her progressive, flourishing program.

“I would also like to say I’m here to help and work with the willing no matter who it may be,” said Davis, whose newly-erected venture services clients nationwide ranging in ages 18-and-up. “I became super passionate about credit repair, especially for minorities and people of color like myself because we are already at a disadvantage in this society. So, having poor credit is just another issue we can and should avoid at all cost.”

“I would also like to say I’m here to help and work with the willing no matter who it may be,” said Davis, whose newly-erected venture services clients nationwide ranging in ages 18-and-up. “I became super passionate about credit repair, especially for minorities and people of color like myself because we are already at a disadvantage in this society. So, having poor credit is just another issue we can and should avoid at all cost.”

There are, by Davis’ estimation, at least seven other reasons why consumers should strongly consider taking advantage of credit restoration or, as she refers to, her credible protection plan.

They are:

- Giving way to lower car insurance rates

- Prevent consumers from paying higher security deposits for apartments

- Bad credit can affect employability

- Unsatisfactory credit can prevent consumers from buying a home

- Lead to a stress free and carefree livelihood, as well as enable consumers to feel good about their improved credit score

- Allow them to rent an apartment and,

- Stop consumers from needing co-signers when making major purchases.

“We are prejudged by where we live — our zip codes known as redlining, as well as the color of our skin and so many other factors,” Davis said. “Having excellent credit should be a priority for us. Teaching our children the importance of credit and how to use it to our advantage are of the upmost important.”

“We are prejudged by where we live — our zip codes known as redlining, as well as the color of our skin and so many other factors,” Davis said. “Having excellent credit should be a priority for us. Teaching our children the importance of credit and how to use it to our advantage are of the upmost important.”

A once high school dropout who has worked diligently in recent years to get her life back on track, Davis has deemed it essential to share of her awe-inspiring journey with others.

As many people as she can, to put it more precisely.

“I’m very receptive to sharing my journey,” Davis said. “It’s not a secret I had poor, janky credit. Unfortunately, I wasn’t educated about financial literacy and I struggled, but I woke up and changed my mindset. Now, I’m financially free and my credit scores are excellent.”

Heck, she’s is only keeping it real.

Or, in modern terms, she’s only keeping it 100.

A RELATED STORY:

For more information about New York Businesswoman Michelle Davis of Michelle Davis Legacy LLC or to inquire about her services, call 516.288.8956 or connect with her via social media at Facebook: https://www.facebook.com/michellemykie; Instagram: https://www.instagram.com/iammykie30/. Also, send email to: davisp27@icloud.com.

CONNECT WITH THIS AWARD-WINNING JOURNALIST FOR MEDIA EXPOSURE

EDITOR’S NOTE: If you are an entrepreneur, business owner, producer, author, athlete, musician, barber, life coach, motivational speaker, cosmetologist, tax preparer, model, or pastor/minister who is seeking exposure and would like to share your story with an in-depth news feature, call Reporter Andre Johnson at 901-690-6587 or Facebook message him under “Andre T. Johnson” for details.

EDITOR’S NOTE: If you are an entrepreneur, business owner, producer, author, athlete, musician, barber, life coach, motivational speaker, cosmetologist, tax preparer, model, or pastor/minister who is seeking exposure and would like to share your story with an in-depth news feature, call Reporter Andre Johnson at 901-690-6587 or Facebook message him under “Andre T. Johnson” for details.

Andre Johnson is the award-winning Founder and Publisher for Making Headline News. A 2000 graduate of the University of Memphis School of Journalism and a former staff reporter of sports for the Memphis Commercial Appeal newspaper, Johnson covers the NBA Southwest Division from Dallas, Texas. To reach Johnson, send email to makingheadlinenews@gmail.com or to memphisgraduate@yahoo.com. Also, follow him on Twitter @AJ_Journalist.